This is an important week in the world of cryptocurrency, because at some point tomorrow (likely around 4:23 UTC on 15 September 2022) the Ethereum network will shift from a proof-of-work (PoW) model to a new proof-of-stake (PoS) system as a consensus mechanism for the authentication of crypto transactions on its blockchain. This new system gets rid of the need for energy-hungry mining in favor of securing the network using staked ETH.

Two outcomes of this change (as reported on ethereum.org) will be that

- This sets the stage for future scaling upgrades including sharding.

- The Merge will reduce Ethereum’s energy consumption by ~99.95%

Because of the sheer number of transactions on its network and projects built on top of its blockchain, such a large change has naturally attracted a lot of attention, speculations, and questions. The switch has been likened to changing out critical parts on a moving train, and as such, things may go wrong. This article will go into how the benefits of the new upgrade might compare to the Zilliqa blockchain going forward, and the benefits it currently offers users.

Two common questions, as reported by CoinMarketCap.com, center around transaction times and gas fees:

Q: Will The Merge reduce my Ethereum gas fees?

A: No. The switch from proof-of-work to proof-of-stake does not actually change anything about the network that would lead to lower gas fees. It’s only with later improvements, including the 2023 sharding upgrade, that should see Ethereum’s throughput dramatically increase as blocks are produced in parallel — bringing down fees as a result.

Q: Will The Merge increase Ethereum transaction times?

A: No. The Merge will actually slightly decrease Ethereum transaction times. Under proof-of-work, Ethereum generates a block every 12-14 seconds (currently averaging at 13.36 seconds). Following The Merge, a new block will be generated every 12 seconds — more than 10% faster than before. This will mean transactions will be confirmed roughly 10% faster in most cases.

via CoinMarketCap

Because the Merge to a new proof-of-stake model will not reduce Ethereum gas fees, there will be (and have been) users looking to build or transact on a blockchain with lower fees. The Zilliqa platform offers such an opportunity with a transaction fee currently at 0.1 ZIL, or a few cents in US currency.

As we saw above, The Merge will slightly reduce Ethereum transaction times with a new block being generated every 12 seconds, instead of 12-14 seconds in the previous system.

Zilliqa’s white paper claims that sharding helps its blockchain achieve processing speeds “a thousand times the transaction rates of Ethereum.” The speed that Zilliqa’s high-throughput blockchain has already accomplished to-date is impressive relative to other platforms available now. Even if nothing goes wrong with the Merge, transaction speeds will be slow relative to Zilliqa’s until Ethereum implements sharding next year.

When putting this into the context of ecological sustainability and how the energy usage of Zilliqa’s current proof-of-work system compares with the Ethereum network’s, we see the following:

The Ethereum network and Zilliqa network share (at least before The Merge) the same PoW algorithm — Ethhash — which comes with ASIC resistance and several other factors that make it justifiable to approximate the characteristics of the mining pools for Zilliqa and Ethereum are linearly proportional — in other words, Zilliqa’s hashpower comes from roughly the same types of machines, running with similar mixes of electric power sources to the Ethereum mining network.

Zilliqa uses PoW, but not necessarily for the same things that you expect. Proof of Work is part of the block minting process on Ethereum and Bitcoin, but Zilliqa only uses Proof of Work to mint the DS block and organize the shards during the beginning of an Epoch. Zilliqa depending on the interval might not use PoW at all as it only needs PoW for one 60 second cycle at the start of a new Epoch for leader election and to resort all nodes into new shards. After that, there is no need to solve puzzles to process Zilliqa transactions, only an online machine with minimal additional resources is required to validate transactions for the network and earn $ZIL in portion to your contribution.

via this article

The article goes on to use stats on Ethereum from the digiconomist site to get an approximation of Zilliqa’s carbon impact in 2021:

This year Ethereum is expected to emit roughly 14.65 Mt CO2 due to its mining activities (comparable to Tanzania) , meanwhile Zilliqa according to this estimate has to atone for 0.009% — a measly 1277 tons CO2. In context this is the carbon footprint of about 85 Americans in 2016.

Carbon emissions from Zilliqa mining is already a very manageable issue. To offset these values we would need to buy offsets from the EUA ICE future exchange for 42 euros per ton, for a total of €53,634 to declare Zilliqa’s PoW activities for this year carbon-neutral. Offsetra would sell us the credits at £7 for a total of about £9K.

In context, Ethereum is on the hook for €615 million this year. Bitcoin has to offset about 2.6 times as much carbon as that, for about €1.6 billion this year.

via this site

As the #2 cryptocurrency in the world right now, Ethereum clearly has a massive user base and provides utility across large numbers and kinds of blockchain projects. Yet when looking at what The Merge will gain Ethereum in the short term especially, it is easy to wonder if there are not other projects that users and investors might find enticing from the perspective of lower use fees (as compared to Ethereum’s gas fees into the near future), transaction times (which will improve marginally as a result of The Merge), and the enabling of more efficient use of energy and thus a lower carbon footprint for the platform as a whole (time will tell how this looks for Ethereum post-merge).

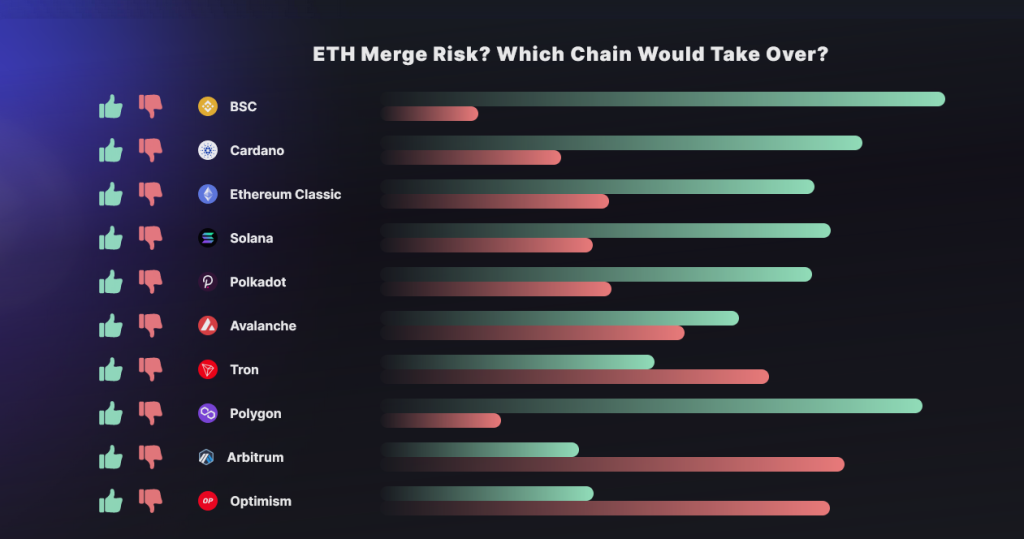

In its article about The Merge, CoinMarketCap has a poll set up asking readers their thoughts about which chain would take over if some of the risks inherent in the ETH Merge would cause the platform to break. Here are the results as of ~10 hours before the estimated time of Merge:

Notably absent from the list is Zilliqa, and this is interesting as the blockchain project currently offers low fees to users, high speeds that are desired by both consumers and builders alike, and enviable energy efficiency in its PoW model. This is all combined with a growing network of commercial partnerships and metaverse-as-a-service offering that show the ecosystem is growing and user base is an enthusiastic one.

Time will reveal the details of how the Ethereum Merge will go, and interested users may want to take a closer look at the Zilliqa blockchain for its current utility and offerings.