USDT, also known as Tether, is the world’s largest stablecoin by marketcap. Its website states that USDT is pegged to the US dollar and backed “100% by Tether’s reserves,” but the recent breaking of its USD peg has raised serious concerns about the nature and stability of its reserves and thus its ability to serve as a “stablecoin” with a consistent value relative to the US dollar. In 2021, the NY Attorney General found that Tether was not backed up at all times with US dollars. This has prompted officials such as US Treasury Secretary Janet Yellen to renew their calls for “Congress to approve federal regulation of stablecoins”.

Does Tether really back its reserves as it promises, or is this a massive scam akin to a pyramid or Ponzi scheme as some researchers have suggested? A USDT crash would cause huge ripple effects throughout the crypto market as a whole because of the sheer number of transactions that are dependent on USDT. What would this mean for the price of Bitcoin and the broader crypto market?

According to a 2021 article by The Verge, USDT coins were “involved in half of worldwide Bitcoin trades. And there have been questions about whether movements in Tether have created price manipulation in Bitcoin. One academic study found that a particular player on the Bitfinex exchange uses newly printed Tether to purchase Bitcoin when Bitcoin prices fall, to support Bitcoin’s price. Apparently, this works.” This type of price manipulation clearly points to a large vulnerability for the price of bitcoin, but this combined with a lack of proper and stated backing of its reserves by Tether also points to a larger price vulnerability and liquidity crisis for crypto coins as a whole. Here are some things other top analysts and bloggers are saying about this situation:

Way back in January 2018, Wired wrote –

Why Tether’s Collapse Would Be Bad for Cryptocurrencies

Tether, a so-called “stablecoin,” is in trouble. Its collapse could trigger a crypto version of a bank run, potentially toppling exchanges and cratering the price of bitcoin and other cryptocurrencies

THE CRYPTOCURRENCY WORLD, with its volatility, is all about FUD—fear, uncertainty, doubt. And nothing is generating more FUD right now than an unusual currency called tether.

Unlike bitcoin and its many siblings, tether is what is called a stablecoin, an entity designed to not fluctuate in value. With most cryptocurrencies prone to wild swings, tether offers people who dabble in the market the option of buying a currency that its backers say is pegged to the US dollar. Trading bitcoin for dollars at a bank can be cumbersome and costly; by comparison, acquiring tether is simple, cheap and fast.

But in recent weeks a chorus of skeptics has called into question nearly everything about tether. The root of the controversy is whether the company behind it, also called Tether, is telling the truth when it claims that every unit in circulation is matched by a US dollar it holds in reserve. If the company has a dollar for every tether, that means in theory any holder can sell tethers back to the company for an equal number of dollars at any time. This belief keeps the value of a tether pegged to a dollar.

Critics on Twitter, Reddit, in blog posts, and at a recent bitcoin conference have been demanding that the company prove its reserves through external audits. Not only has Tether failed to do so, last week it confirmed rumors that it had severed ties with Friedman LLP, the accounting firm on tap to perform those audits. On Tuesday, Bloomberg reported that the US Commodity Futures Trading Commission had sent subpoenas to Tether. A Tether spokesperson said, “We routinely receive legal process from law enforcement agents and regulators conducting investigations. It is our policy not to comment on any such requests.” The spokesperson declined other comment.

If tethers are not backed by a matching number of dollars, then Tether can print an arbitrary amount of money. (Other cryptocurrencies, by contrast, create new tokens according to strictly prescribed, predictable rules.) Other problems ensue, including suspicions that Tether is timing the release of new tethers to coincide with drops in the price of bitcoin and then using those tethers to scoop up bitcoins. Some observers fear that these purchases are artificially inflating the price of bitcoin. “It’s possible that a nontrivial rise in the price of bitcoin and other cryptocurrencies has come from this asset being printed possibly out of thin air, and that is very concerning,” says Jill Carlson, a former Wall Street trader who now invests in and consults for cryptocurrency startups.

If traders lose faith in tether, they could end up triggering the crypto version of a bank run. Tether helps stabilize cryptocurrency exchanges in various ways, so its collapse could also cause some exchanges to topple, wiping out billions of dollars of investments overnight and potentially undoing much of the public’s growing interest in new technologies like bitcoin.”

Earlier this week on May 12, 2022, Matthew Fox of Business Insider worried that

“A collapse of Tether could be crypto’s ‘Lehman Brothers moment’ as the world’s top stablecoin begins to wobble and major tokens plummet, analyst says”

- A collapse of the Tether stablecoin would be crypto’s “Lehman Brothers moment,” according to an analyst from GlobalBlock.

- Following Terra’s collapse, the $81 billion Tether stablecoin began to deviate from its $1 peg.

- “I am optimistic that [Terra’s] fall would not be that catastrophic — a collapse of [Tether] would be though,” GlobalBlock said.

Crypto markets are getting roiled this week following the collapse of Luna and its related stablecoin, Terra, which deviated by more than 50% from its $1 peg this week.

The implosion of Terra has spread to other stablecoins in recent days, including Tether, which is the largest stablecoin based on its $81 billion market capitalization. Investors have long questioned what reserves Tether has to back up its $1 peg, and the stablecoin traded off as much as 5% to $0.95 early Thursday.

The destabilization of various stablecoins could represent crypto’s “Lehman Brothers moment” as investors begin to worry about the systemic risk ingrained in cryptocurrency markets.

During the 2008 Great Financial Crisis, Lehman Brothers went bankrupt due to its overexposure to bad credit, and around the same time money market funds broke the buck, or deviated from its dollar peg due to extreme investor sentiment.

But crypto can avoid its “Lehman Brothers moment” as long as Tether doesn’t go down the same path as Terra, according to GlobalBlock analyst Marcus Sotiriou.

“Some have called this a ‘Lehman Brothers’ moment due to the contagion this may cause, however I am optimistic that UST’s [Terra’s] fall would not be that catastrophic — a collapse of USDT [Tether] would be though, and we have seen the largest stablecoin by market cap wobble over the past 24 hours,” Sotiriou said in a note to Insider.

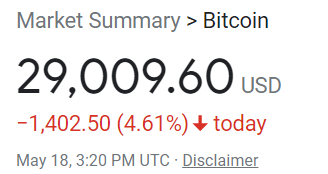

With a current BTC price today of ~$29,009

and half of all bitcoin transactions involving Tether in some way shape or form (as well as the manipulations described above), would a crash of Tether bring the price of BTC down to the $15,000 USD level? We hope not, but time will tell.